Super stapling

Introduced as part of Your Future, Your Super reforms, stapling legislation aims to reduce the impacts of holding multiple super accounts. Employers have a key role to play.

Introduced as part of Your Future, Your Super reforms, stapling legislation aims to reduce the impacts of holding multiple super accounts. Employers have a key role to play.

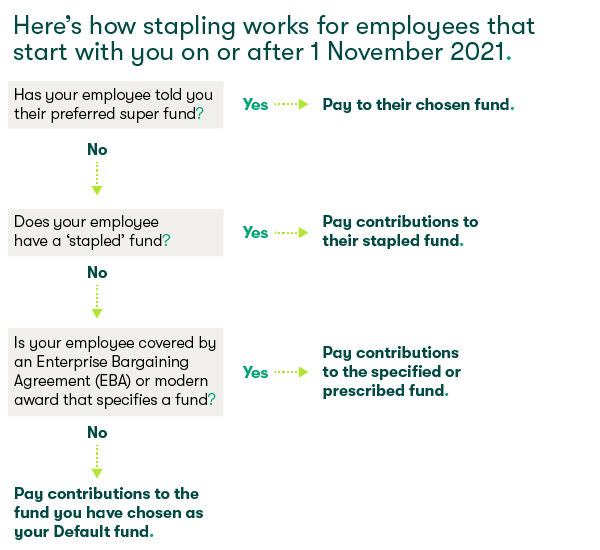

When onboarding a new employee, they will automatically retain their existing super fund when they start their employment with you, unless they choose another fund or are new to the Australian workforce.

As an employer, you will play a key role in super stapling. When onboarding new employees, you need to undertake a stapled fund search if the new employee doesn’t give you a completed Standard Choice Form nominating their chosen fund.

The stapled fund search can be done by logging into the ATO online services and entering the employee’s details. If a stapled fund exists, super contributions must be paid into that fund.

PDF 264876 KB

Your existing employees will not be affected by these changes during their employment with you. You will need to continue to pay their super contributions into the same super fund that you currently do.

New employees will still be able to elect their own choice of super fund, including the employer’s default fund, by completing the Standard Choice Form - regardless of whether they already have a stapled account.

In this instance, employers are not required to complete a stapled fund search.

You will still need to have a default fund option available to new employees who aren’t already a member of a super fund and don’t choose a fund of their own. In this instance, you will need to create an account with your default fund to pay their super contributions to.

Yes, employers can still change their default super fund arrangements.

In most cases, employees would need to consent to rollover their existing balance across to any new fund. Contributions would be required to continue being directed to an employee’s existing account if the account is the employer’s previous default fund, if the account is a ‘stapled’ account, or where the employee has made a choice of fund.

However, you will be able to pay contributions into your new default fund for employees who commence their employment with you after you change your default fund where they do not have a stapled fund or do not complete a Standard Choice Form; or if they elect to have their contributions paid into your default fund.

Whether you’re already a Catholic Super employer or not, we’re here to help you navigate these changes. If you have any questions regarding stapling and the Your Future, Your Super reforms, speak to your Relationship Manager.